“lack of stock is driving FOMO (‘fear of missing out’) in the market.”

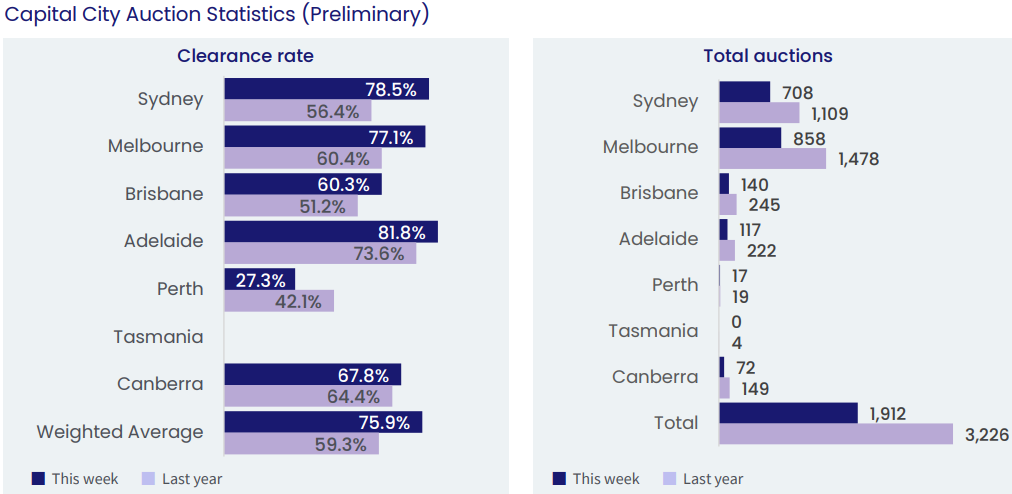

Preliminary data from CoreLogic shows that Sydney’s residential auction clearance rate rose to 78.5% in the week to Saturday, which was its equal best result since February 2022.

Melbourne’s preliminary clearance rate rose to 77.1% – the seventh consecutive result above 70%.

Whereas the national preliminary clearance rate rose to 75.9%, which is its highest level since November 2021:

SQM Research managing director, Louis Christopher, notes that both investors and first-home buyers are active at present, although he cautions that another increase in the cash rate in June could see a pause in housing market activity.

“First home buyers are active in the market. They are being squeezed by the rental market. Investors are also active, they’re capitalising on the increase in rents”, Christopher said.

To read the full article from MACROBUSINESS click here

Article Source: macrobusiness.com.au