What is a Tax Depreciation Schedule?

A Tax Depreciation Schedule is a report which allows you to claim back the depreciation costs of your income producing property.

The depreciation schedule covers the structural building and items (such as appliances and fittings) within it – it does not cover personal items such as furniture.

Too vague? Click here for further details.

How much does a Tax Depreciation Schedule Cost?

Depending which company, you chose to go through, the costs can vary. Professionals clients can expect to receive a discounted fee of $715 (incl GST) if they opt to go through BMT. This is a one-off fee and is 100% tax deductible.

BMT will provide you with a schedule that will cover all available deductions for forty years.

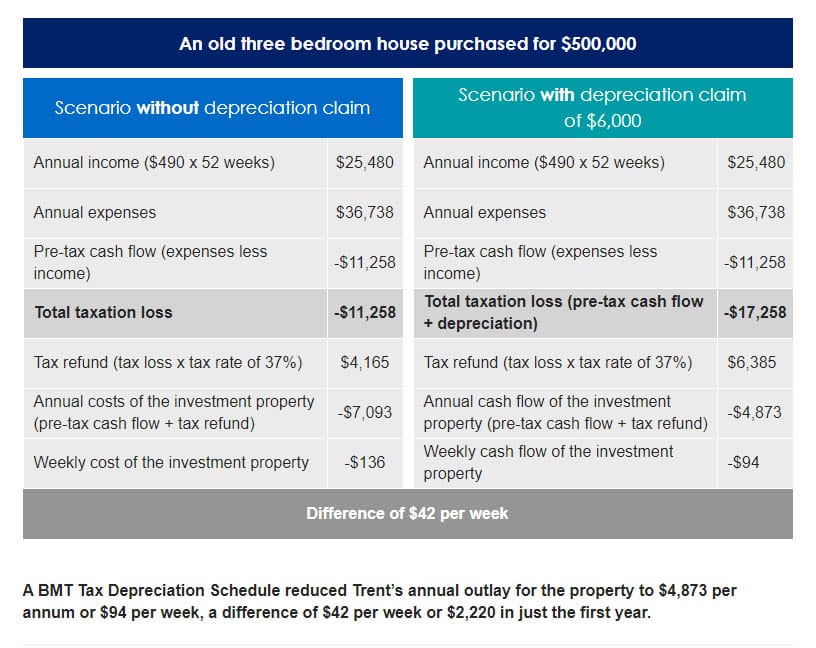

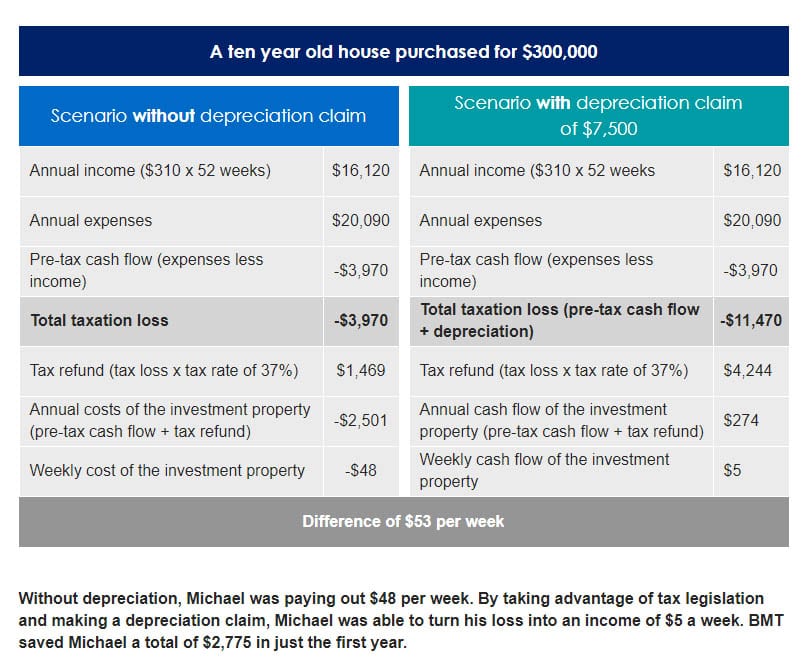

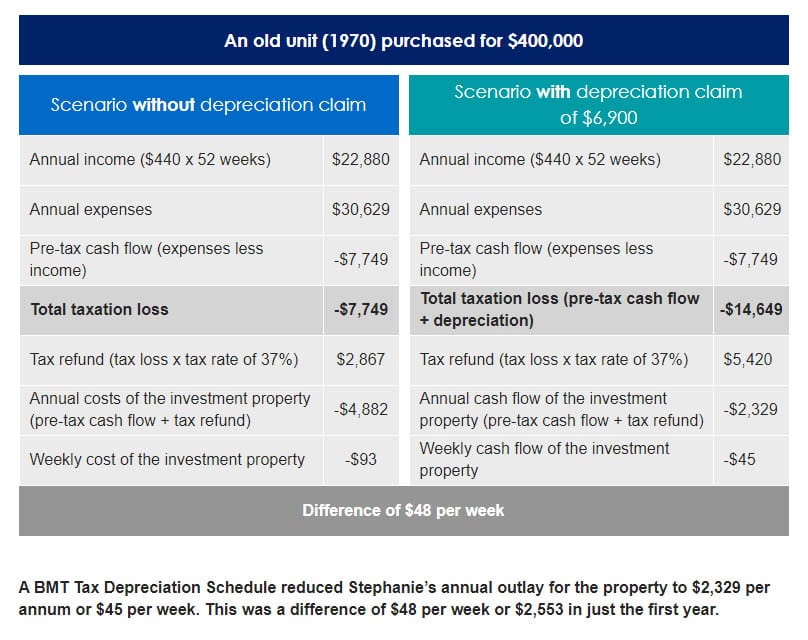

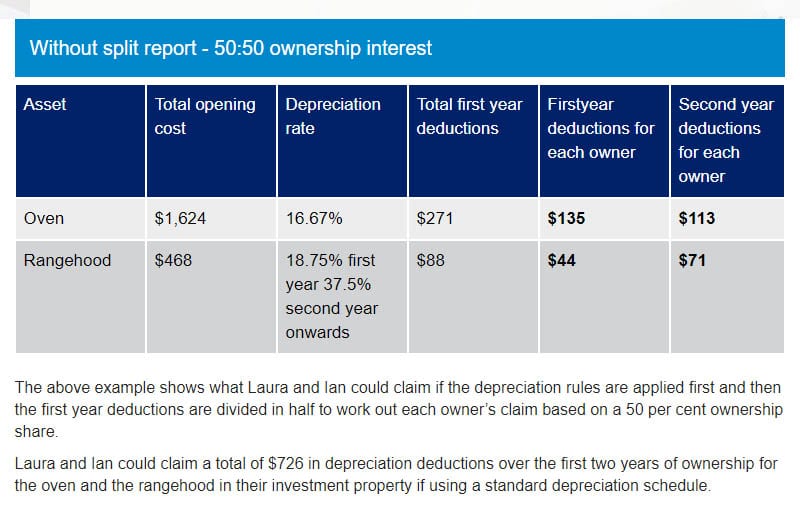

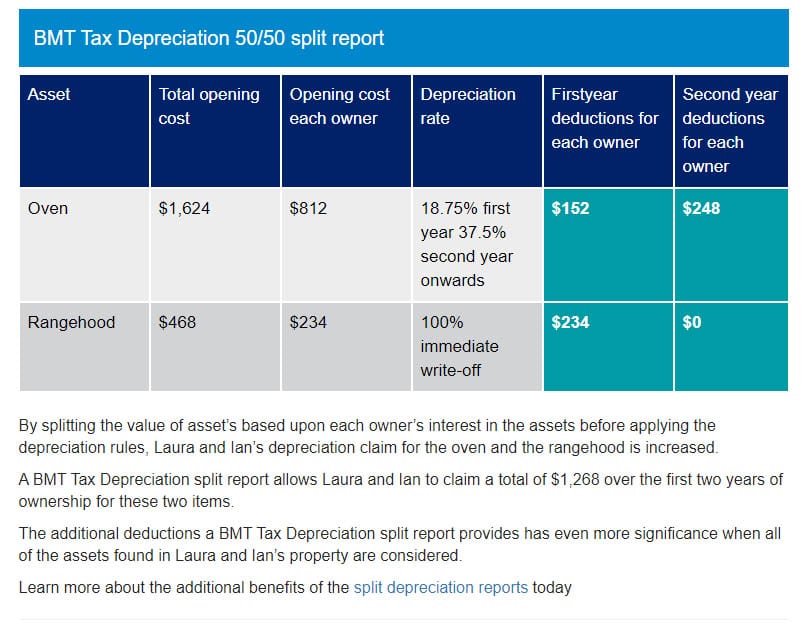

Case Studies

If you are wondering if you should get a Tax Depreciation Schedule but not sure if you want to outlay the cash; have a read of some of the case studies taken from the BMT website:

Below are the figures on each scenario, feel free to click on each image for further details on each specific case.

To arrange a depreciation schedule, please give us a call on 08 8382 3773 and we can help arrange this for you at a discounted price.

Follow the Professionals Christies Beach real estate agency.

Tax Depreciation Schedules

08/07/2020

Article posted by Professionals Christies Beach real estate agency